We have many people who contact us about financing long term care. Sometimes there has been a diagnosis of Alzheimer’s or another long term debilitating disease, and sometimes there has been a fall or a sudden illness that puts the family in crisis mode. In any case, it is not unusual to have to undo and restructure some preliminary Medicaid planning the family or another lawyer has done, which can make it harder—not easier—to access long term care benefits available through Medicaid.

Medicaid Eligibility

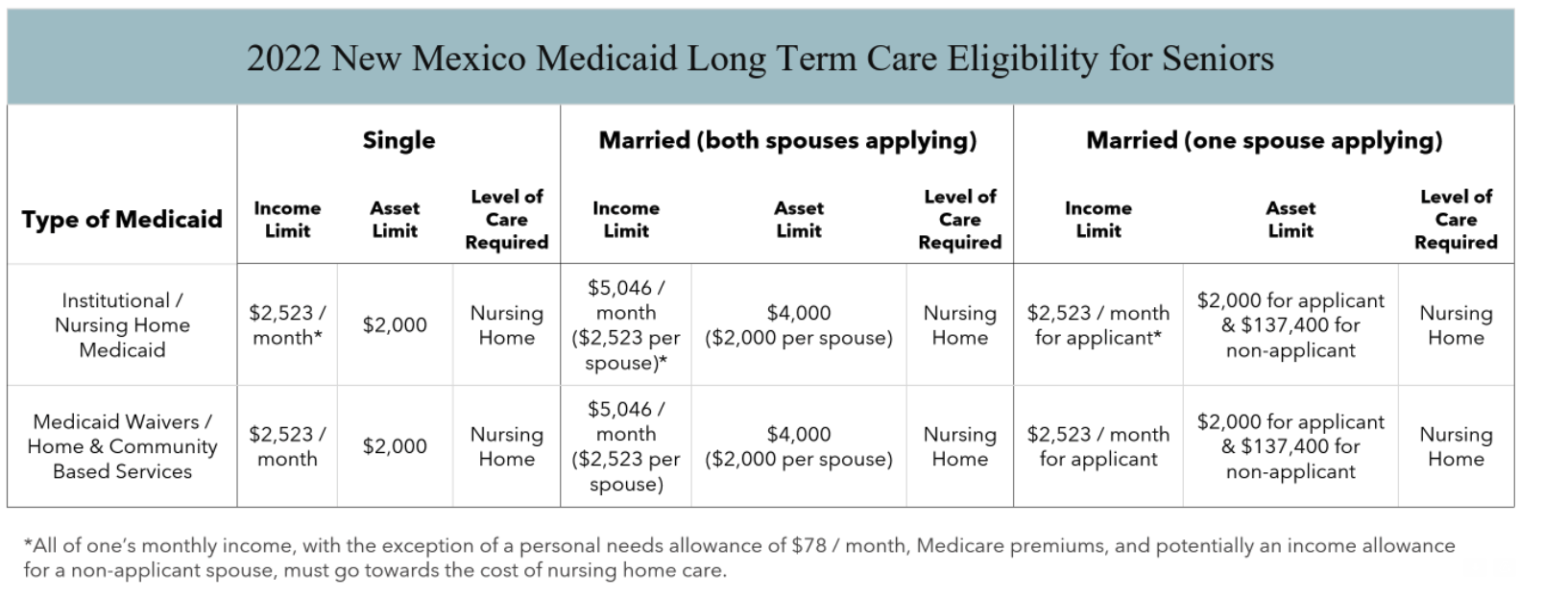

The threshold for Medicaid eligibility is the applicant must be sick or disabled and in need of services. Then, the applicant must also be indigent, which means that the applicant, if single, must have countable resources of no more than $2,000, and monthly income of no more than $2,523 (in 2022). The limits on income and assets depend on one’s marital status and, if married, whether one or both spouses are applying for Medicaid long term care (see chart below). For example, if the applicant is married and their spouse is not also applying for Medicaid, it is possible to blend the income and assets with the spouse, but the applicant is still limited to the numbers above, while a non-applicant spouse may retain $137,400 (in 2022) in countable assets and can retain all of their income no matter how much it is. If the applicant spouse has more income than the threshold, sometimes it works for us to add the two incomes together and then divide by two, and if the result is less than the threshold, we can use that number.

*All of one’s monthly income with the exception of a personal needs allowance of $78 / month, Medicare premiums, and potentially an income allowance for a non-applicant spouse, must go towards the cost of nursing home care.

Countable Assets

It is important to understand what assets are, or are not, countable in determining Medicaid eligibility. There are many assets that Medicaid considers exempt (non-countable). Exemptions include personal belongings, household furnishings, an automobile, and burial accounts (limited to $1,500 if not prepaid and irrevocable). One’s primary home is also exempt if the Medicaid applicant lives in it or has intent to return and their home equity interest is not more than $636,000 (in 2022). Equity interest is the home’s value, minus any debt against the home, in which the applicant owns. The home is also exempt, regardless of any other circumstances, if the applicant has a spouse living in it. It is important to note, while one’s home is generally exempt from Medicaid’s asset limit, it is not exempt from Medicaid’s estate recovery program. Following a long-term care Medicaid beneficiary’s death, the New Mexico Medicaid agency may attempt reimbursement of care costs through whatever estate of the deceased still remains. This is often the home. Without proper planning strategies in place, the home can be used to reimburse Medicaid for providing care.

Exemptions

- Personal belongings

- the value of one automobile

- recreational vehicles such as boats, RVs or trailers

- Household contents

- Prepaid funeral contracts (as long as they are irrevocable)

- Home (subject to limits)

- Annuities that are “actuarially sound”*

- * many annuities that are purchased commercially are not actuarially sound according to the Medicaid rules.

- Active businesses that are supporting the family

What are counted are real estate other than the home no matter where located, all cash accounts, securities accounts, retirement accounts and the cash value of life insurance.

If the assets are too high for eligibility, the applicant must do a “spend down” in order to meet Medicaid eligibility criteria. If the applicant is already a resident of a nursing home, we suggest applying for Medicaid at the end of the first month of residency to establish what needs to be spent down. The spend down can be accomplished by paying off debt and converting countable resources to non-countable assets. We strongly recommend that you obtain legal advice when planning for the spend down.

If income is too high, we can prepare an Income Diversion Trust, which effectively brings the income to zero for the applicant.

It can be confusing to navigate the Medicaid system. The attorneys at PBWS Law can help you avoid common pitfalls and craft a plan for a path forward for you and your family. Contact us today so we can help you plan properly for the long term care of you or a loved one.

LINKS:

- Disability & Long Term Care Planning Attorneys | Albuquerque (pbwslaw.com)

- What is an Elder Law Attorney and Do I Need One? – PBWS – Albuquerque & Santa Fe Law Firm – Trust, Probate, Estate, Elder Law (pbwslaw.com)

- Intent to Return: Qualifying for Medicaid & Protecting the Home (medicaidplanningassistance.org)

- What is the Medicaid Estate Recovery Program (MERP)? (medicaidplanningassistance.org)